- Banks Savings Accounts Interest Rates

- Bank Of India Saving Account Interest Rate 2021

- Central Bank Of India Saving Account Interest Rate

- Saving Bank Rate Of Interest

For account holders with cheque book facility, without cheque book facility, and for a no-frills savings account, the interest rate is 4%. What are the proofs to be submitted for address verification while opening a Central Bank of India savings account? IDFC FIRST Bank's Savings Account is our testament to putting our customers first. We offer one of the industry’s best savings account interest rates at 6% p.a., for balances up to Rs 1 Cr. What's more, you earn this interest on progressive balances in each interest rate slab, as applicable. That means you earn every single day. Saving deposits balance above Rs 1 crore charges 4 per cent per annum interest rates. Savings Bank account can also be linked to Multi Option Deposit (MOD) account for earning higher term deposit.

Coronavirus(Covid-19): support for our customers:We are closely monitoring the coronavirus(Covid-19) situation in U.K and taking sensible precautions to make sure our customers are not inconvenienced

Customer Attention Please: On account of ongoing nationwide lockdown due to Covid-19 Pandemic all our UK branches viz. London Branch,Birmingham Branch,Leicester Branch,Glassgow Branch and Wembley Br View More...

As per data compiled by BankBazaar, new private banks such as Bandhan Bank and IDFC First Bank offer interest rates of up to 7.15 per cent and 7 per cent, respectively on their savings account.

Customer attention please : On account of ongoing nationwide lockdown due to Covid-19 Pandemic,our Leicester branch is working on reduced hours from 10:00 a.m. to 2:00 p.m in line with timings of oth View More...

Coronavirus (Covid-19) Notice 2 : Please read our Coronavirus (Covid-19) Notice 2 for latest updates

Customer attention please: Change in Branch Timings: In view of the UK Govt. instructions on travel restrictions, timings of Bank of India UK Branches will be changed to 10:00 a.m. to 03:00 p.m.

Customer attention please: No Transaction Payments allowed w.e.f. 01/02/2019. Only viewing facility is available for all the Internet Banking Customers View More...

Bank of India is authorised in UK by Prudential Regulation Authority (PRA) and regulated by PRA & Financial Conduct Authority (FCA). Our financial service registration NO. is 204629 A member of Fin View More...

No postal applications will be accepted for new Retail Deposits with effect from 02-08-2016, till further notice. View More...

Are you searching for the Best Savings Bank Account in India? Are you hunting for the top and trending accounts to earn better interest? Not to worry, we have also compiled a list of Best Savings Account in India, Interest rates and various important criteria for selection of a good savings account.

Savings bank account, one of the basic and simplest way to keep your money securely. Each one of you might be having one for sure! If not, some of you might be planning to open a savings account soon.

Why do you need a Savings Account? Importance

A simple short answer to this question is:To keep your money safe. Keeping your money at home will not serve any purpose or fetch you any interest. It is anyways advisable to put even a small part of your savings in a bank account. So, you can easily transfer and reinvest the amount deposited in a savings bank account as per your financial objectives.

A detailed answer to the above query is:

- Security: For security of your hard earned money.

- Interest: For earning a fixed rate of interest on the amount deposited.

- Liquidity: So that you can withdraw money and use it as and when need arises.

- Simplicity: It is probably the simplest mode of investing your money and earning fixed returns thereon.

- Net-banking facilities: These days banks offers online banking facilities where you can easily transfer amounts whenever required.

- Automated payments: You can give standing instructions for auto payment of bills and auto debits for certain transactions in a hassle free manner.

Savings Bank Accounts: Types

Here are some of the common types of savings account that you get to see:

1. Regular Savings Account:

A common basic savings account used by an account holder following the basic terms and conditions of the bank.

2. Salary based Savings Account:

These are normally opened by Companies for their employees, where the salary of the employees is transferred on a monthly basis.

3. Savings Account for Senior Citizens:

These are similar to regular savings account, but offer higher rate of interest and certain privileges to senior citizens.

4. Savings Account with exclusive benefits to Women:

Few banks offer these type of accounts where exclusive benefits and features are provided to women.

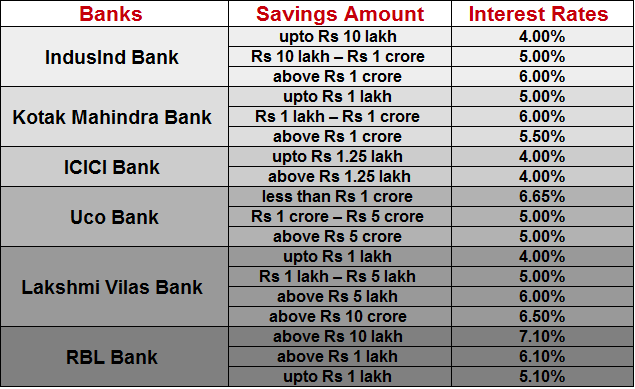

Banks Savings Accounts Interest Rates

5. Savings Account for Minors:

These accounts are opened by parents/guardians on behalf of their children.

6. Zero balance Saving Account:

You are not charged any penalty on such account, if the balance falls below the minimum limit. Many banks offer a zero minimum balance savings account. Do have a look at Best Digital Savings Bank Account in India.

Now, coming to the point, the next step is to decide the best bank to open Savings account. You need to consider few important points to decide Which bank is best to open Savings Account?

Just keep in mind all these crucial points before deciding the best bank to open savings account for yourself.

Best Savings Bank Account in India: Features

Here are some of the important features that you must look into while choosing the best savings account:

1. Interest Rate:

This is the first and foremost criteria that we normally consider while looking for a savings bank account. We prefer opening a savings bank account with a bank that offers higher interest rates.

Majority of banks provide interest rate on Savings account in between 3% to 4% only. Few banks may provide a bit higher interest rate at around 5-6%. Some banks also provide high interest rates beyond a certain amount of daily balance in your account. e.g. If your daily balance is above Rs.1 lakh they might offer you 5% interest or even higher as per bank norms.

The interest is usually credited in your account at the end of every quarter: 30th June, 30th September, 31st December and 31st March.

If you are the one who has to maintain a large balance in your savings account, then you should prefer banks offering higher rate of interest, to get good returns. But, if you wish to maintain a nominal amount in your bank account and diversify the rest of your money, you need to consider other factors as well.

Note: Recently some of the banks have reduced the saving account interest rate to 3.5% only.

Important: You can avail a tax deduction under section 80TTA on the interest earned on your savings bank account upto a maximum of Rs.10000.

Now, you might be thinking…Which bank offers the highest interest rates? Which is the best saving bank account?

Don’t miss to checkout the list of Interest rates on Savings bank account in India as given below.

2. Minimum Balance Requirement:

There is a minimum balance that you need to maintain in your account, so that your account remains active. Private sector banks generally require to maintain a higher amount of minimum balance as compared to Public sector banks.

If your balance falls below the minimum limit, the bank charges maintenance fee for the same.

The average monthly balance requirement can vary from a minimal amount to as high as Rs.10000 or Rs.20000 or even a higher amount as per their rules. This is based on the type of account you open and the bank where you open the account.

So, if you can afford to maintain a particular balance in your account, this should not be your primary concern.

You may also like: 10 Best Credit Cards in India

3. Facilities Offered:

Bank Of India Saving Account Interest Rate 2021

These days almost all banks offer similar facilities like debit card, credit card, ATM access, net banking facilities, mobile banking etc. However, talking about online facilities, banks like BOI, ICICI, Axis are good. But, as far as physical reach is concerned you might see that SBI has more no. of physical branches.

These days most banks offer useful mobile banking apps for easy access to various services from anywhere. A bank offering better facilities and prompt customer support is anyways a preferred choice amongst individuals.

4. Customer Service:

Generally, private banks have an image of offering better services and customer support. However, there can be few exceptions to it. Even if banks provide online facilities these days, but there might be cases where you might need to visit the branch offices. In such a situation, good customer support and helpful staff is an added advantage for you.

5. Charges/Fee:

Banks usually charge for any extra service offered like cheque book issue, minimum balance not maintained etc. So, you should clarify about any hidden charges beforehand.

6. Location of Branches:

This is not a major concern. But, a bank having substantial number of branches all over India will be more beneficial in case you are a frequent traveler. So, if you relocate from one place to another, this will make life easier for you. A nearby ATM is surely an added advantage for you.

See what are your priorities are and consider these important criteria before opening a saving bank account.

Also, have a look at Best 3-in-1 Demat Account in India

Best Bank to Open Savings Account in India:

These are not in any particular order. Your choice may vary based on your requirements, location, purpose, services offered and so on.

- State Bank of India or SBI

- RBL Bank

- Axis Bank

- Kotak Mahindra Bank

- Citibank

- Bank of India

- RBL Bank

- HDFC Bank

- ICICI Bank

- Canara Bank

- Union Bank

- Bank of Baroda

- Lakshmi Vilas Bank

- IndusInd Bank

- Bandhan Bank

Also have a look at Kotak 811 Savings Bank Account Review

Interest Rate on Savings Account in India:

Here’s a table displaying interest rates charged by different banks on savings account in India

| Bank | Savings Bank Interest Rate |

|---|---|

| Digibank by DBS | 3.50% - 6.00% |

| Bandhan Bank | 4.00% - 7.15% |

| RBL Bank | 5.00% - 6.75% |

| Axis Bank | 3.50% - 4.85% |

| Kotak Mahindra Bank | Upto 4.00% |

| IndusInd Bank | 4.00% - 6.00% |

| SBI | 2.70% |

| ICICI Bank | 3.00% - 3.50% |

| IDFC Bank | 6.00% - 7.00% |

Remember, the interest rate vary as per the balance in your savings account, a higher balance usually attracts higher interest rate. But, it may not be beneficial to keep all your savings in a single place. You must learn to diversify your investments.

The above list has been prepared on “as is ” basis, there might be changes in the above interest rates of different banks from time to time. Do check with the respective banks and their branches before opening a saving bank account for yourself.

Important: Recently some of the banks have reduced the saving account interest rate to 3.5% only from the previous 4% interest rate.

Central Bank Of India Saving Account Interest Rate

You may also like: Best Current Bank Account for Small Business

Best Savings Bank Account: Which one to Choose?

Saving Bank Rate Of Interest

As far popularity is concerned, RBL Bank has gained a lot of traction recently. It offers a high savings account interest rate of 6% – 6.75% p.a. based on the balance you have in your account.

For a high interest bank alternative, IndusInd also scores well by providing 6% interest rate on your savings account.

Looking for a zero balance savings account, Kotak 811 Digital Bank could be an ideal choice. You can instantly open it online on your laptop or mobile.

If you look for good internet banking, ICICI bank does well in this arena. This can be a great fit for the tech savvy person looking for faster online services.

If you look for location and number of branches, State Bank of India or SBI is a decent choice. It is a Public sector bank and has a nominal minimum balance requirement as well. The customer support is also good in various branches.

Best Savings Bank Account India: A Final Review

To conclude, we can say, one should look for the best services and a great customer support. If you generally get a quick response to all your queries through the friendly customer support that some banks offers, it feels great. Many banks provide good services, you need to see which one will suit your preferences.

However, we must be very active and alert while putting in our hard earned money. You already know the Yes bank story so far, that’s really concerning for a depositor. Right!

Kindly note that these are personal opinions, however individual preferences may vary from person to person.

Ideally, a common man should be looking for a nearby branch providing good customer service and great net banking facility as well. However, this may vary as per your individual requirements. So, firstly make sure, you want to go for a higher interest rate only or you want to have a look at other important deciding factors as well.

Note:Before opening a Bank account, do checkout the interest rate, minimum balance requirement, feasibility and variety of services offered and any charges thereon.

Also, grab details on an emerging concept in the banking sector: Payment banks in India

Have you decided which is the best savings bank account based on your needs and priorities? Feel free to share your individual experiences with different banks in India.

Keeping a large sum of money in a Savings bank account is not advisable. This is mainly due to the low returns that you get on it. Therefore, you must look forward to diversify your excess funds. For exploring better and higher returns, you must explore different long term investments alternatives and invest your money wisely.