The First Home Loan Deposit Scheme is now in effect, starting from 1 January 2020. The government – backed scheme is designed to help Australians get into their first home sooner. Here’s everything you need to know.

The scheme promises to give eligible first home buyers a “leg-up” when buying their first home, by allowing them to get a home loan with a deposit of as little as 5%. To put it simply, the government is agreeing to be ‘guarantor’ to loans taken under the scheme. Generally you need a deposit of at least 20% of the purchase price of the property. Any less than this and you'll need lenders mortgage insurance. Even if you don't have a 20% deposit, we may still be able to lend up to 95% of the purchase price. The minimum genuine savings amount required is no less than 5% of the purchase price.

The National Housing Finance and Investment Corporation (NHFIC) has designed this scheme intended to help first home buyers purchase their own home by foregoing lender’s mortgage insurance.

It provides a guarantee that will allow eligible first home buyers on low and middle incomes to purchase a home with a deposit of as little as 5%.

The Scheme will support up to 10,000 loans each financial year.

How does it work?

The scheme promises to give eligible first home buyers a “leg-up” when buying their first home, by allowing them to get a home loan with a deposit of as little as 5%.

To put it simply, the government is agreeing to be ‘guarantor’ to loans taken under the scheme. In addition, buyers will not have to worry about taking out Lenders Mortgage Insurance.

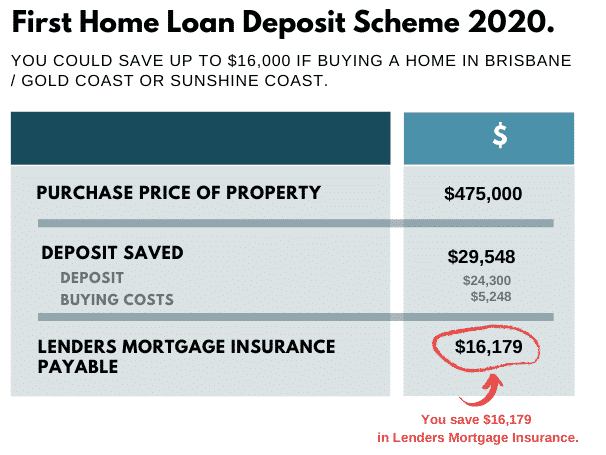

Ordinarily, when a buyer with a deposit of less than 20% takes out a home loan, they are required to take out Lenders Mortgage Insurance, a form of insurance designed to protect the lender in the event of a loan default.

Instead, buyers will be able to put all this money towards the deposit, potentially saving approximately $10,000 in insurance costs and, in theory, allowing them to enter the market sooner.

Show me the fine print

The scheme will not be available to everyone and will operate on a first come first served basis- so make sure to get in quick. To be eligible, you will need to be a first home buyer on an income of up to $125,000 annually (or up to $200,000 for a couple). The scheme will also be capped at 10,000 loans per year, meaning it will only be available to less than 10% of the 110,000 first home buyers who take out loans every year.

In addition, you will need to have already saved for a deposit of between 5 to 20% of the property’s value. This means if you are looking at a $600,000 home, you will need to have at least $30,000 in the bank to cover the deposit alone.

Buyerswho plan to take up the scheme should also be cautioned that it is not ‘freemoney’. Banks and lenders will still be carrying out all their regular checks to ensure the borrower will be able to meettheir repayments.

Related Text: What are the costs involved in buying a home? — the upfront and hidden fees

Eligibility for the scheme

To apply to the Scheme, you’ll have to meet the followingeligibility criteria. You need to be able to provide documentation of youreligibility to secure your position.

Eligibility criteria includes:

- All applicants must be First Home buyers

- Individuals must have earned less than $125,000 and couples less than $200,000 in the last financial year. Couples must be married or de-facto

- All applicants must be at least 18 years of age, Australian citizens and have a Medicare card

- There are property price caps which vary depending on the location in which you buy. You can work out your property price cap using NHFIC’s online tool

NHFIC’s Scheme eligibility tool

Use the NHFIC’s online tool to help understand whether you are eligible for the scheme. Simply choose choose whether you wish to apply as an individual or as a couple.

How much can I borrow?

Eligibility for the scheme will also depend on the region you are buying in. The NHFIC has developed a tool to help first home buyers find out the property price threshold for the suburb in which they are looking to purchase a property. Each state and region comes under a different property threshold.

How can I apply?

The First Home Loan Deposit Scheme started on 1 January 2020.

You will need to approach a participating lender to lodge an application.

It is recommended that any prospective applicants seek independent legal or financial advice when devising their loan arrangements.

Which lenders are involved?

The NHFIC has appointed 27 lenders on the panel of residential mortgage lenders to offer guarantees under the Scheme.

The major lenders that will be involved in the scheme are Commonwealth Bank and NAB, who are expected to be able to provide 50 percent of the 10,000 loans guaranteed loans for each financial year.

The 25 non-major lenders who are involved, many of which mutual banks or credit unions, will start offering guaranteed loans from 1 February.

Words by Kathryn Lee

Ready to get started? Enquire now to kick – start your home loan journey with one of our experienced brokers helping you find an option that’s right for you.

Click to compare over 25 lenders

You might also like:

Thank you for subscribing!

Processing

Like what you're reading? Subscribe to our top stories.

Let’s look at getting a home loan with 5% deposit.

As mortgage brokers we are often asked what deposit is needed for a home loan.

The New Zealand banks are restricted by Reserve Bank rules (LVR rules) which means that they will normally ask for a 20% deposit; however they still have the ability to do some lending with as little as 5% deposit. They have always had the ability to do this, but in most cases they won’t unless the applicants are deemed as very attractive to the bank and there is good reason for not having the deposit available.

There are two specific types of loans where you can get a home loan with a 5% deposit;

1: First Home Loan

First Home Loan is exempt from the LVR rules introduced by The Reserve Bank.

From the 1st October 2019 the Government backed Welcome Home Loan has had a name change to First Home Loan. Another change is the deposit that was required for a Welcome Home Loan was 10% and now with the First Home Loan it has been reduced to 5%.

The First Home Loan is managed by Housing New Zealand and we have contacted them today to see if there are any other changes but they are not aware of any yet.

One issue with Welcome Home Loans and that will remain with First Home Loan is that not all banks have chosen to be part of this scheme.

Other issues are the house price caps and income caps which mean it is often not going to work.

Check our the website: CLICK HERE

Note: The announcement from the Government in the KiwiBuild reset lacked detail and Housing New Zealand staff who managed the Welcome Home Loans and First Home Loans knew very little about any of the changes. We will be checking and updating this post next week once the Housing New Zealand website is updated in case there are other changes that we are not aware of. We will also be checking with the banks to see if they will be offering the 5% deposit loans and what the individual bank criteria will be.

2: New Build Finance

New Build Finance is also exempt from the LVR rules introduced by The Reserve Bank.

The banks are therefore able to offer home loans for new builds with less than 20% deposit.

Most banks will offer finance for both turn-key and progress payment builds with 10% deposit and a few will offer lending with a 5% deposit.

The issue with financing builds is the high risk for cost overruns. Most builds are financed with fixed price contracts, but often they have PC sums (price cost estimates) for some of the work including but not limited to the ground work. With lower deposits the banks want to eliminate the risk of cost overruns so will want a contract with no PC sums.

There can be other ways to get a low deposit home loan.

You can get low deposit home loans with the banks at times, and some banks will allow you to use guarantors. The non-bank lenders will often do home loans with 10% deposit and they will generally allow a second mortgage which can be used to fund the balance of what would otherwise be your deposit.

Speak to your mortgage broker and they can help explain the options.

Are There Extra Costs?

When you require a home loan with a 5% deposit there will be extra costs.

Welcome Home Loans (First Home Loans) charges a Lender’s Mortgage Insurance (LMI) premium of 1% of the loan account and the lender may also apply a loan application fee.

Refinance Home Loan 5 Year

The banks will charge a low equity margin too which is an increase on the home loan interest rate. These vary in the way that they are calculated so you want to ensure that you select the right bank or that your mortgage broker knows about the differences too.

How To Get A Home Loan With A 5% Deposit

5 Home Loan Deposit Eligibility

It is not easy to get a home loan with a 5% deposit, but it may be possible.

The easiest way to get started is to complete an online application (use the link below) and one of our team can check before discussing with you.

Home Loans 5 Down

It costs you nothing to assess your situation, so why not find out today.